As the golden hues of the California sun begin to intensify, the smooth hum of air conditioners across SoCal echo a unison melody. But, as we rely more on our trusted HVAC systems to shield us from the heat or chill, our utility bills may tell a different story — one that entails a significant surge in cost. Before you resign yourself to shelling out huge sums, we invite you to explore a treasure trove of untapped potential — a realm of abundant rebates and tax credits. These rewarding tidbits can make your HVAC upgrades in Southern California not just more efficient, but also remarkably wallet-friendly. Intrigued? Come, journey with us through this enlightening pathway and unlock the vault of savings that await your HVAC systems.

Understanding the Concept: Rebates and Tax Credits for HVAC Upgrades

If you’re a Southern California resident planning to upgrade your heating, ventilation, and air conditioning (HVAC) system, there’s good news. Aside from improving your home’s comfort and indoor air quality, there’s a chance to recoup a significant portion of your investment through various rebates and tax credits. This post will explain how these savings work and can contribute to lowering your initial outlay. The first saving opportunity comes in the form of rebates offered by utility companies. These rebates are incentives created to entice homeowners to upgrade to energy-efficient HVAC systems. For example, Southern California Edison (SCE) and Southern California Gas Company (SoCalGas) have rebate programs for qualifying HVAC systems. Here are few more benefits you can enjoy:

- Save on power bills with energy-efficient systems

- Improve the value and comfort of your home

- Contribute to environmental sustainability

Furthermore, you could benefit from federal tax credits. The federal government often provides tax credits to incentivize energy efficiency. For instance, the Federal Energy Efficiency Tax Credit, which had been expired, was renewed in December 2020 and made retroactive to include 2018 and 2019. This provides a tax credit valued at 10% of cost up to $500 or a specific amount from $50-$300 for energy-efficient upgrades including HVAC systems.

| Component | Tax Credit |

|---|---|

| Advanced Main Air Circulating Fan | $50 |

| Natural Gas, Propane, or Oil Furnace | $150 |

| Natural Gas, Propane, or Oil Hot Water Boiler | $150 |

| Energy-efficient Heat Pump | $300 |

Before making a purchase, be sure to conduct thorough research on available rebates and tax credits to make sure your chosen HVAC system qualifies. Consulting a tax pro can also save you a lot of headache in the long-run. Homeowners who invest time in understanding these incentives will surely reap the benefits.

How SoCal Residents can Unlock Massive Savings with HVAC Upgrades

Living in Southern California and looking for an exceptional way to save on energy costs? Well, HVAC upgrades might just be the answer! Not only would they help in drastically reducing your energy bills, but there are also an array of rebates and tax credits available for making such improvements. As per the Federal Government, a tax credit of up-to $500 is available to homeowners who have made energy- saving HVAC upgrades. Furthermore, several different entities including monopoly utilities, municipalities, and the state of California, offer substantial rebates to residents who invest in energy-efficient HVAC systems.

Let’s start by briefly discussing rebates. The most common are those offered by utility companies such as Southern California Edison, San Diego Gas & Electric, and Southern California Gas Company. These rebates often range from $150 – $1,000.

In addition to this, the California Energy Commission offers a ‘Energy Efficiency Rebate Program,’ where residents can get up-to $650 back on their HVAC upgrades. Moreover, certain counties and cities also provide rebates for HVAC updates under the ‘Energy Upgrade California Program.’

| Program | Offering Entity | Rebate Amount |

|---|---|---|

| Energy-Saving HVAC Upgrades | Federal Government | Up-to $500 |

| Utility Rebates | Southern California Edison, San Diego Gas & Electric, Southern California Gas Company | $150 – $1,000 |

| Energy Efficiency Rebate Program | California Energy Commission | Up-to $650 |

| Energy Upgrade California Program | Various Counties and Cities | Varies |

As for tax credits, the best known is the Federal Non-Business Energy Property Credit. This can cover 10% of the cost up to $500 for certain HVAC system upgrades. Plus, the Renewable Energy Tax Credit can provide up to 26% back on installed costs if you’ve added solar-ready HVAC systems.

It’s important to note that to maximise the benefits from these programs, your chosen HVAC system should meet the energy efficiency requirements specified. Flexibility, thorough knowledge of rebate/tax credit application process and close attention to utility bills are the keys to unlock substantial savings with these HVAC upgrades.

Deep Dive: The Role of HVAC Equipment in Energy Efficiency

The main takeaway for homeowners and businesses is that installing energy-efficient HVAC equipment has the potential to greatly reduce energy bills. An added bonus to these savings is that you could also qualify for rebates and tax credits, easing the initial investment. In Southern California, for example, several programs offer these incentives to promote the use of high-efficiency HVAC units. The Southern California Edison Utility Company offers the ‘Energy Efficiency Rebate’ to customers who install HVAC units with a Seasonal Energy Efficiency Ratio (SEER) of 15 or higher. Individuals can receive up to $750 in rebates. Similarly, the Los Angeles Department of Water and Power provides the ‘AC Optimization Program’, offering free AC tune-ups plus $150 in energy efficiency rebates.

| Program | Utility Company | Rebate Amount |

|---|---|---|

| Energy Efficiency Rebate | SoCal Edison | Up to $750 |

| AC Optimization Program | LA Department of Water and Power | $150 plus free AC tune-ups |

As for tax credits, the federal government does offer the ‘Non-Business Energy Property Tax Credits’ for new, energy-efficient HVAC units. If your unit meets or exceeds a SEER of 16, you could be eligible for a tax credit of up to $500. Remember: California also offers a variety of additional state and local incentives to upgrade. Always check with your utility provider and municipality to see available offers. With a little bit of research, you can help your wallet and the environment at the same time.

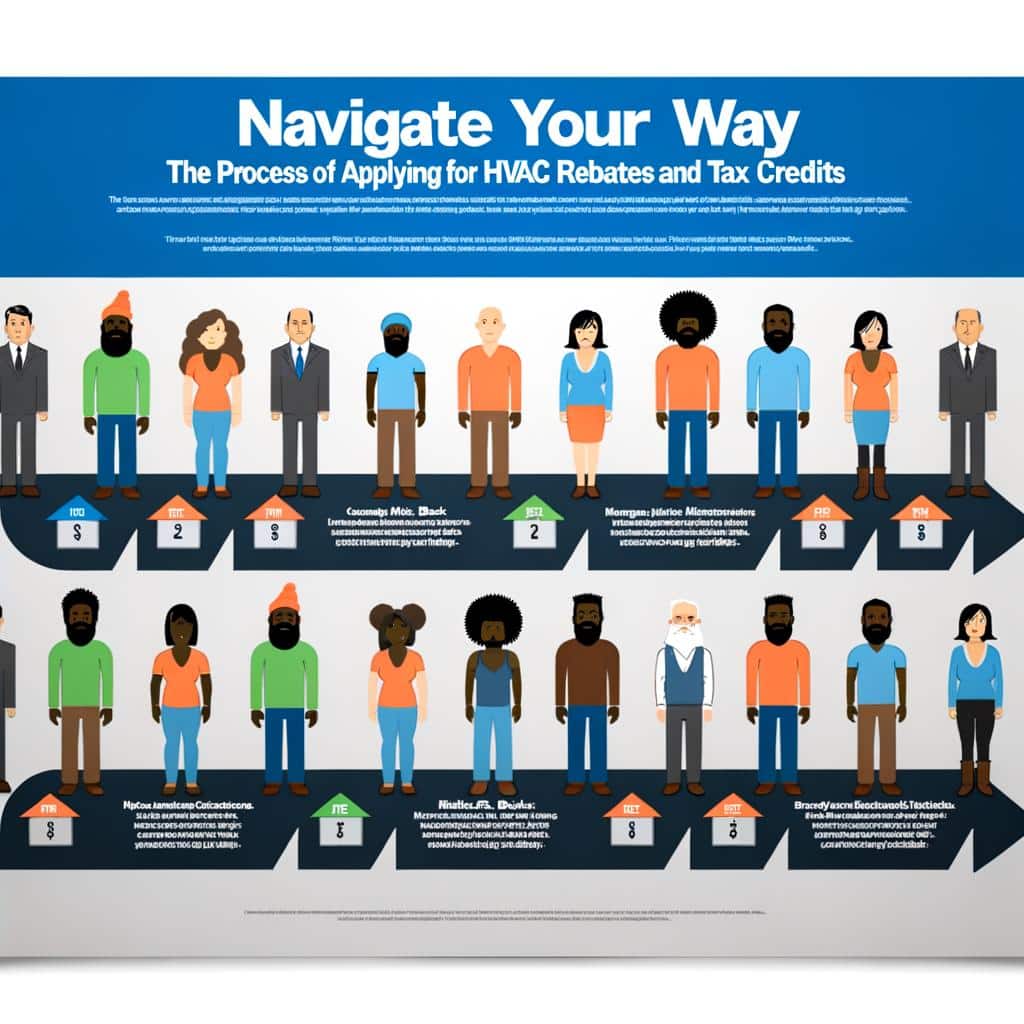

Navigate Your Way: The Process of Applying for HVAC Rebates and Tax Credits

Understanding Rebates and Tax Credits

When it comes to attaining an HVAC upgrade in Southern California, there are numerous options available to lessen your financial load. One of these options is exploring rebates and tax credits offered by the state and federal government, as well as utility companies. Most rebates are either instant or mail-in and can save you a significant amount of money on your HVAC system. On the other hand, tax credits are applicable on your income tax return where you subtract the amount of the credit from your total tax bill.

In case you’re wondering how to identify these rebates and tax credits, we’ve outlined the two-step process below:

| Research: | Initially, you need to conduct a thorough research on the available HVAC rebates and tax credits. This includes consulting the Database of State Incentives for Renewable and Efficiency (DSIRE), which provides comprehensive information on state, local, utility, and federal incentives that promote renewable energy and energy efficiency. |

| Application: | After identifying a suitable rebate or tax credit, the secondary step is applying for it. Depending on the program, this could mean completing an online form, or in some cases, mailing a physical application. Remember to include all the required documentation, which generally include sales receipts and proof of installation. |

By following these instructions, you’re on the right path to shave off a significant amount of money from your HVAC upgrade costs.

Stepping into a Greener Future: Environmental Impact of Upgrading HVAC Systems

Are you planning to upgrade your home or business HVAC system soon? If the answer is yes, then it’s time to consider going green, not just for the sake of environmental preservation, but also for the financial incentives available. The State of California offers significant rebates and tax credits to incentivize energy efficient upgrades to HVAC systems.

To give you a better idea, the Southern California Edison (SCE) offers an Energy Efficiency Rebate that can reach up to $750 for residents who install energy efficient HVAC systems. Other programs like the Federal Energy Efficient Tax Credit can provide up to $500 in tax credits for homeowners. Further, utility companies including san Diego Gas & Electric and SoCal Gas offer additional rebates for installing energy efficient HVAC systems. Review these offers and identify the best fits for you:

| Program | Rebate/Credit Amount |

| Southern California Edison (SCE) | Up to $750 |

| Federal Energy Efficient Tax Credit | Up to $500 |

| San Diego Gas & Electric | Varies, check site |

| SoCal Gas | Varies, check site |

When you upgrade to an energy efficient HVAC system, you are not only significantly reducing your carbon footprint but also potentially saving on utility costs, and unlocking access to rebates and tax credits. It’s like hitting two birds with one stone. The savings you get from the rebates and tax credits can help offset installation costs, making it a win-win situation for homeowners and the environment!

Your Personalized Guide: Choosing the Right HVAC Upgrade for Maximum Savings

Knowing the potential costs of an HVAC upgrade can make the decision-making process much easier. Something that many homeowners in Southern California might not be aware of are the hefty savings that can be implemented through HVAC rebates and tax credits. These financial incentives are offered by utility companies and federal organizations to encourage homeowners to upgrade their HVAC systems to more energy-efficient models.

Key factors to consider when choosing an HVAC upgrade

- Energy Efficiency – The purchase price of an energy-efficient HVAC unit may be higher than less efficient models. However, you may be able to recoup your initial investment through lower energy costs and rebates.

- Size and Capacity of the Unit – An HVAC upgrade that’s not in proportion to your home may mean inefficiency and extra energy costs. This is where professional guidance should be sought.

- Cost – In addition to the upfront cost, consider the long-term costs associated with each type of HVAC system, such as maintenance costs, lifespan, and the availability of rebates or tax credits.

To help you grasp potential savings, let’s consider a hypothetical situation. Let’s say the total cost of your HVAC upgrade is $10,000, and you can take advantage of a $3000 rebate and a 26% federal tax credit. You could potentially recover $5,600 of your initial investment. Here’s how the calculation works:

| Initial cost of HVAC upgrade | $10,000 |

| – Rebate | $3,000 |

| – Federal Tax Credit (26%) | $2,600 |

| Total Cost After Rebates/Credits | $4,400 |

This simple example proves that rebates and tax credits can significantly reduce the overall investment of an HVAC upgrade. Therefore, be proactive about learning and exploring these opportunities as they can facilitate great savings in the long run.

In the shimmering heat of SoCal, your HVAC system becomes more than just a luxury; it’s the frontline soldier battling scorchingly hot days and surprisingly frosty nights. But before you give a hefty chunk of your savings to a shiny new upgrade, don’t forget to explore the hidden treasure of rebates and tax credits. These are often buried, forgotten in the labyrinth of legal jargon, yet offer invaluable financial relief. So, remember, as you embark on your quest of upgrading your HVAC system, Rebates and Tax Credits are your loyal allies, ready to help you unlock massive savings. It’s time to step forward, leverage these incentives, and make your Southern California home an energy-efficient fortress while staying kind to your wallet. This concludes our journey through the landscape of “Unlock Savings: Rebates & Tax Credits for SoCal HVAC Upgrades”. Armed with this knowledge, go forth, my dear reader, and conquer your quest. Your fiscally prudent future in SoCal awaits!